The Middle East's premier Alternative Data provider for finance

NLP-powered tradable insights that put you ahead of the curve!

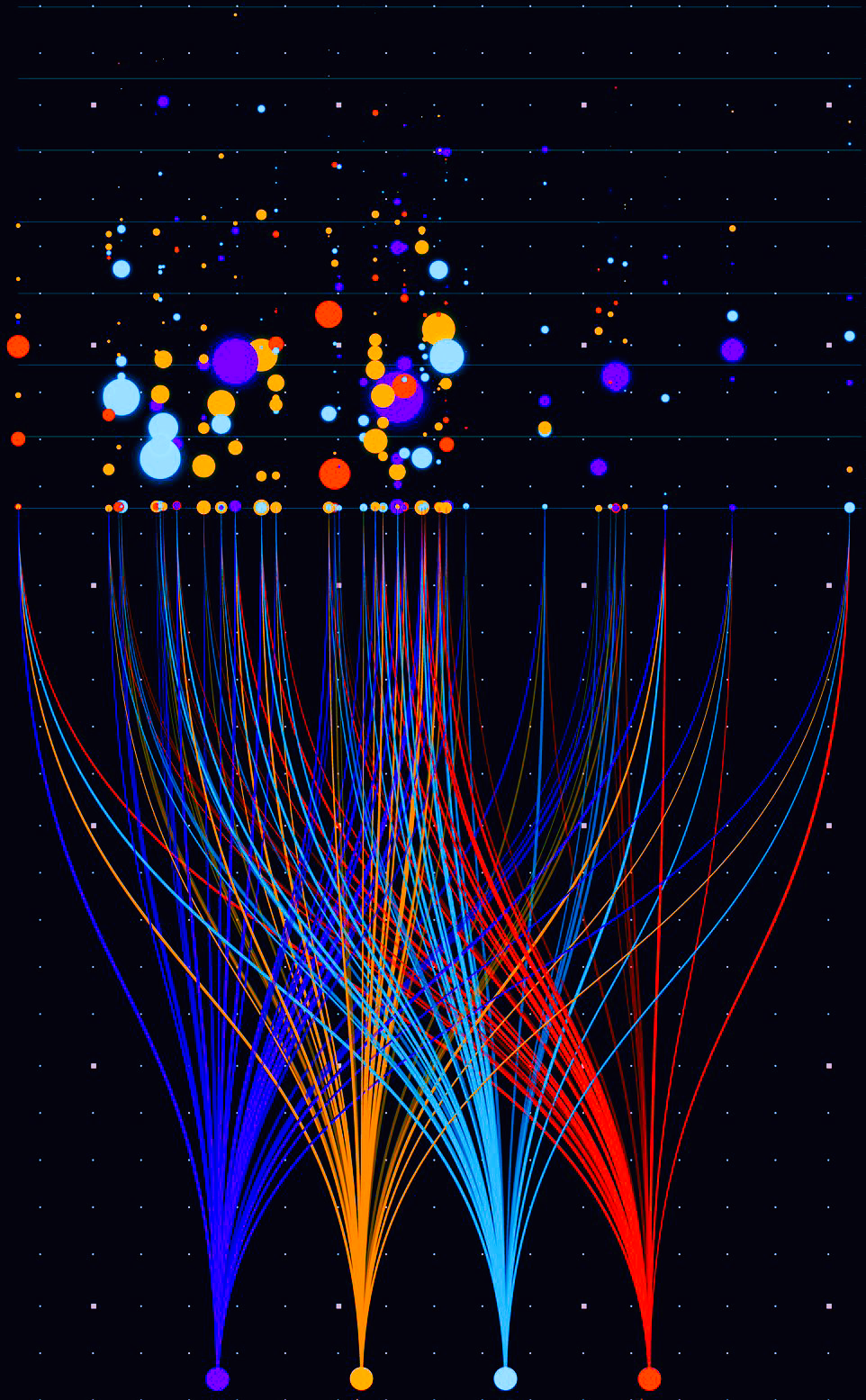

Capture alpha-driving insights and uncover early risk signals with NLPify's cutting-edge Language AI and text quantification techniques.

Our clients trust our

tickerized sentiment

analysis and topic modeling

to predict equity movements and detect anomalies in real time, with unparalleled precision.

Partner Data Exchanges & Marketplaces

The region's first alternative datasets designed by

big data engineers

and

NLP scientists

for

NLPify

is an AI platform that extracts sentiment from financial textual and voice data covering MENAT assets; public and private. Resulting alternative datasets and investment analytics are used by institutional

investors to

generate alpha,

manage risk, and

repack NLP-driven investment products

via data and software as a service (DaaS & SaaS) subscriptions.

Alata

Alice

Open Sans

Noto Sans

Bebas Neue

Great Vibes

Rock Salt

Exo

Belgrano

Overlock

Cinzel

Indie Flower

Staatliches

Roboto Slab

Lato

Noto Serif

Open Sans

Montserrat

Ubuntu

Rubik

Delius

Amiri

Montserrat

So much data, so little time!

so much better!

Thanks to its state-of-the-art proprietary Natural Language Processing (NLP) engine, NLPify is able to analyze and transform thousands of unstructured data sources into structured and curated datasets, all in real-time!

Leveraging our vertically integrated AI technology allows for opportunity, risk, and trend detection across markets, sectors, and assets in question.

Public & Private Assets

Public & Private Assets

Two types of alternative datasets; Public Dataset

(equities, bonds, sukuks) and Private Dataset

(startups, scaleups, growth companies).

Impactful Data Sources

Impactful Data Sources

Text mining news, social media, trading forums, research notes, financial reports, and transcribed audio news.

Multilingual Scraping

Multilingual Scraping

Data scraping is conducted in English, Arabic, French, and Turkish.

We have reimagined market analysis and portfolio management

We have reimagined market analysis and portfolio management

We are creating the new norm and reshaping the way both the buy-side and sell-side approach regional financial markets: Introducing

"NLP Analysis"; a next-generation market analysis methodology that

integrates well with fundamental, technical, and quantitative research.

More than Numbers & Charts

More than Numbers & Charts

Insights from text data leverages information which is not necessarily captured in "the numbers" or "the charts".

Asset Polarity

Asset Polarity

It is more than just asset pricing "legacy factors". NLP techniques for investment analysis quantify market breadth and asset sentiment.

Explainable Asset Returns

Explainable Asset Returns

Analytics from text data allows for further evidence to explain and interpret asset returns.

No More Oversight

No More Oversight

Continuous information edge to avoid oversights and sudden market moves.